Build Community. Build Wealth.

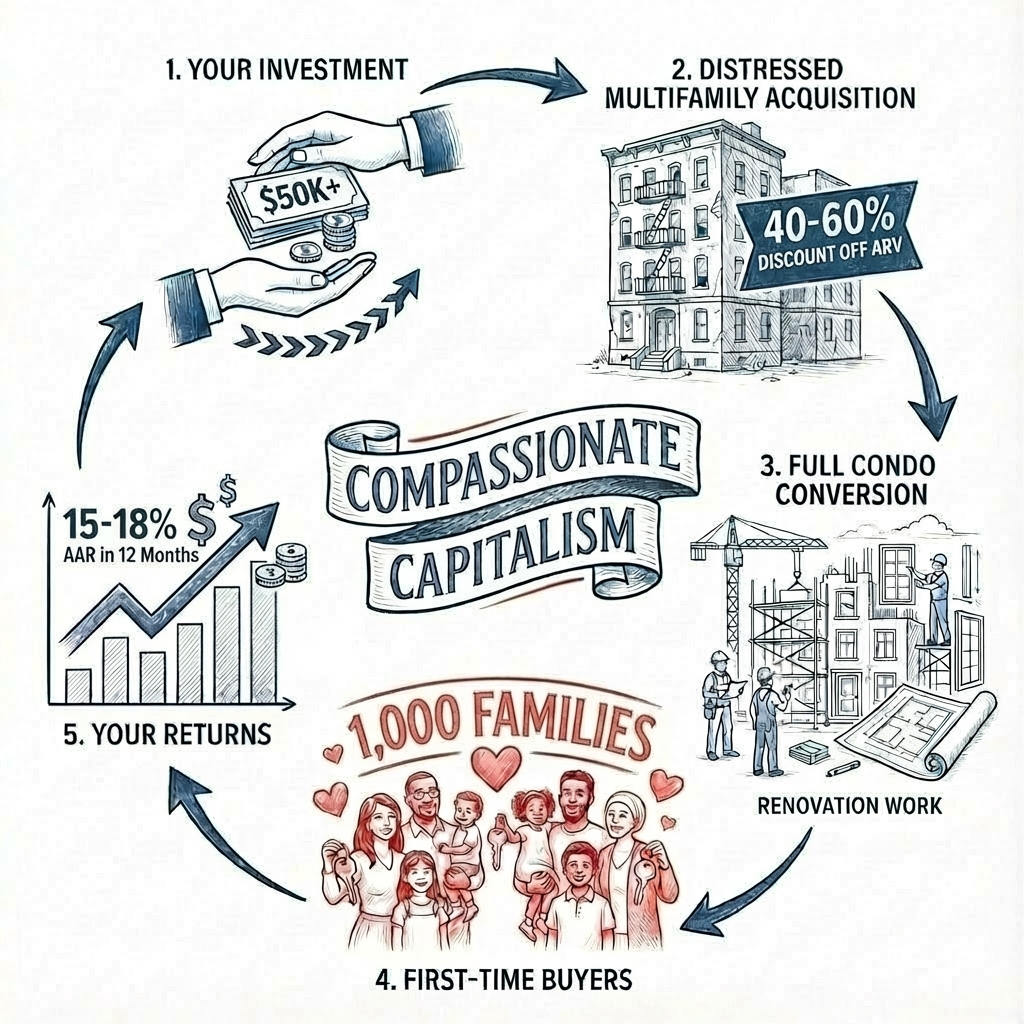

While Solving America’s Affordable Housing Crisis. Earn passive returns helping 1,000 families buy their first home—properties they couldn’t afford without you.

It’s not charity. It’s Compassionate Capitalism.

Dual Mission

Build Community. Build Wealth. (Not One or the Other—Both)

For Your portfolio

15-18% Average Annual Return (AAR) in 12 Months

Minimum Investment: $50,000

SEC Reg D 506(c) Compliant

for first-time buyers

Homes at 80% Area Median Income (AMI)

20% down payment assistance

Mortgage parity with current rent payment

Permanent wealth-building opportunity

This is what impact investing looks like when it’s done right.

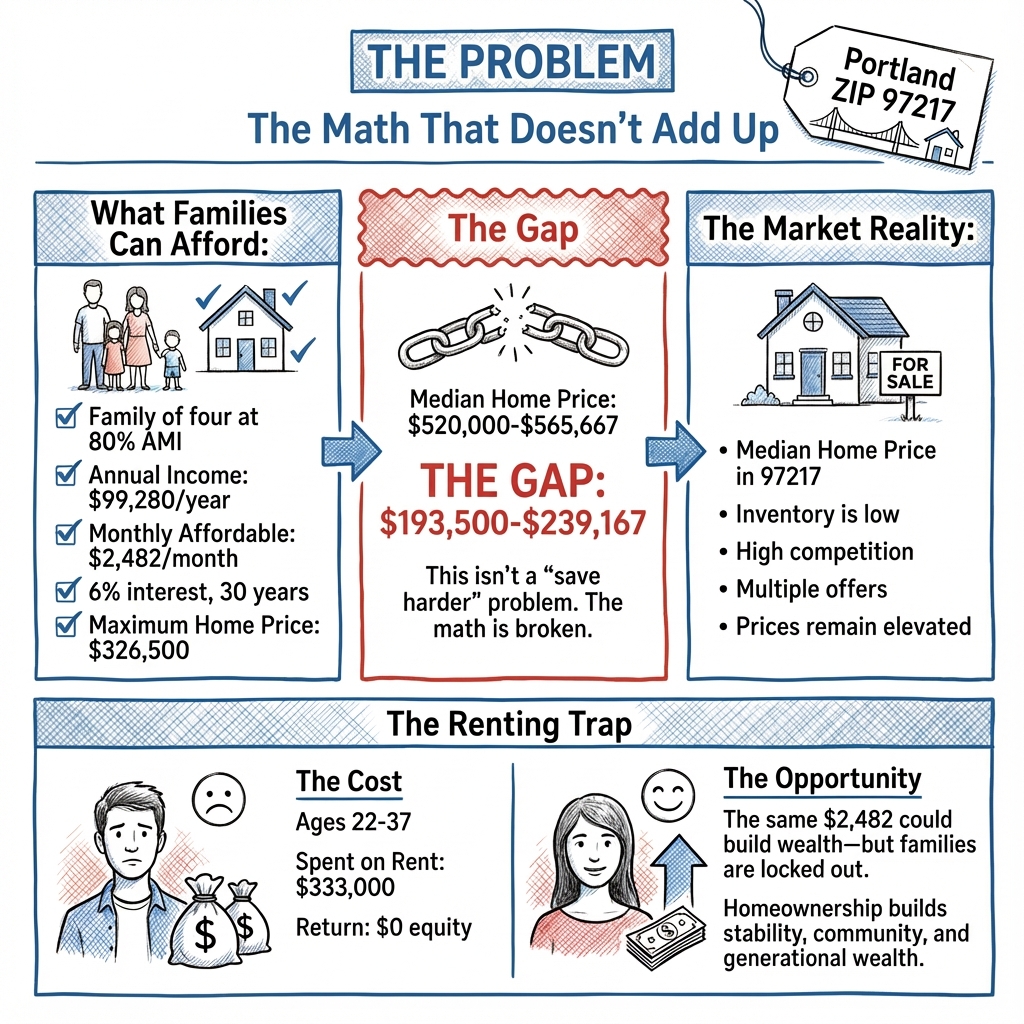

The Problem

A Case Example: Portland

The Math That Doesn't

Add Up

At Portland ZIP 97217, a family of four at 80% AMI ($99,280/year) can afford $2,482/month for housing.

At 6% interest over 30 years, that buys a $326,500 home.

Portland's median home price: $520,000–$565,667.

The Gap: $238,500.

The renting trap

Ages 22–37, renters spend $333,000 on rent. Return: $0 equity.

The same $2,482 could build wealth—but families are locked out.

First-time buyer age:

In 1981 = 29 years old.

In 2026 = 40 years old.

11 years stolen from wealth building.

NATIONWIDE CRISIS

90,000 affordable units could convert to market-rate annually. This isn't Portland's problem—it's America's problem.

The system has failed families.

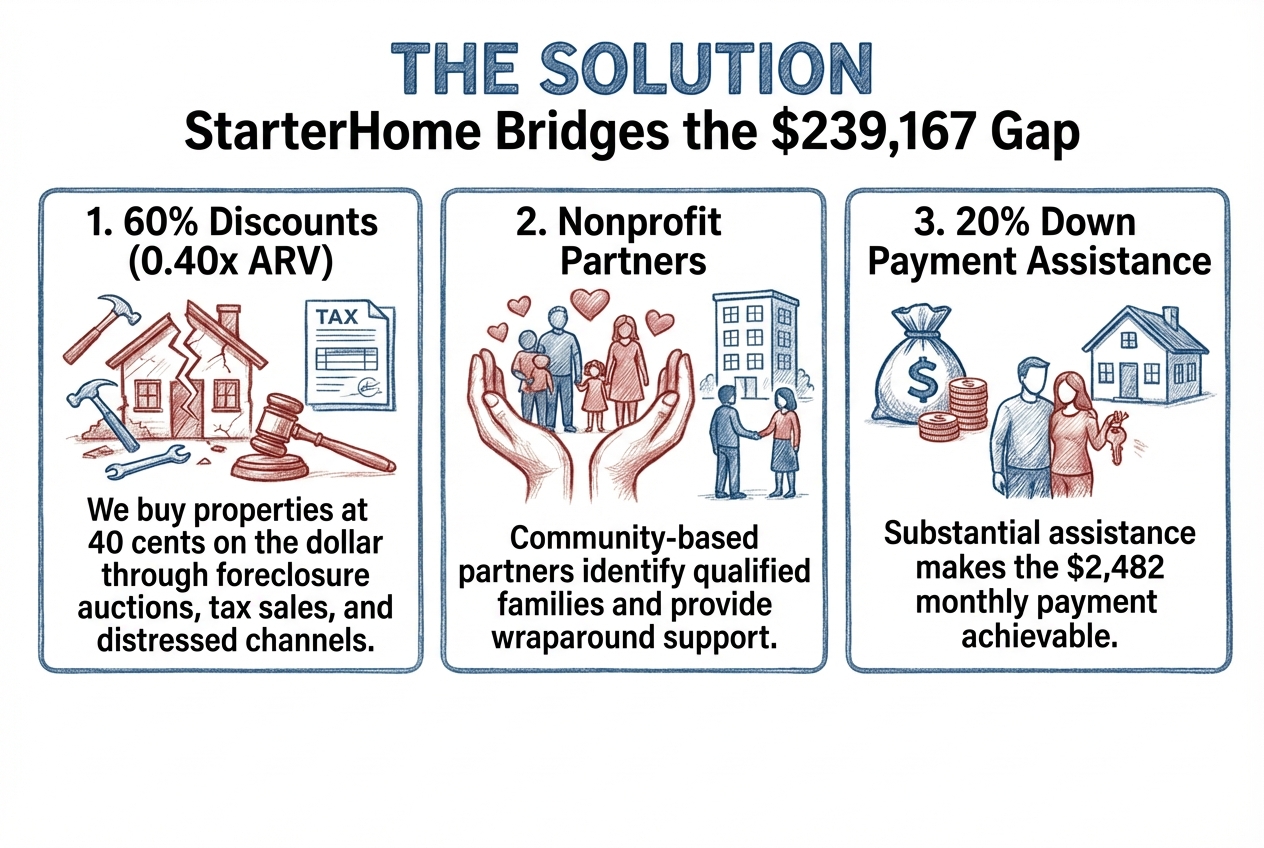

The Solution

This is how StarterHome Bridges the Gap

60% Discounts (0.40x ARV): We buy properties at 40 cents on the dollar through foreclosure auctions, tax sales, and distressed channels.

Nonprofit Partners: Community-based partners identify qualified families and provide wraparound support.

20% Down Payment Assistance:

Substantial assistance makes the $2,482 monthly payment achievable.

Proven Results

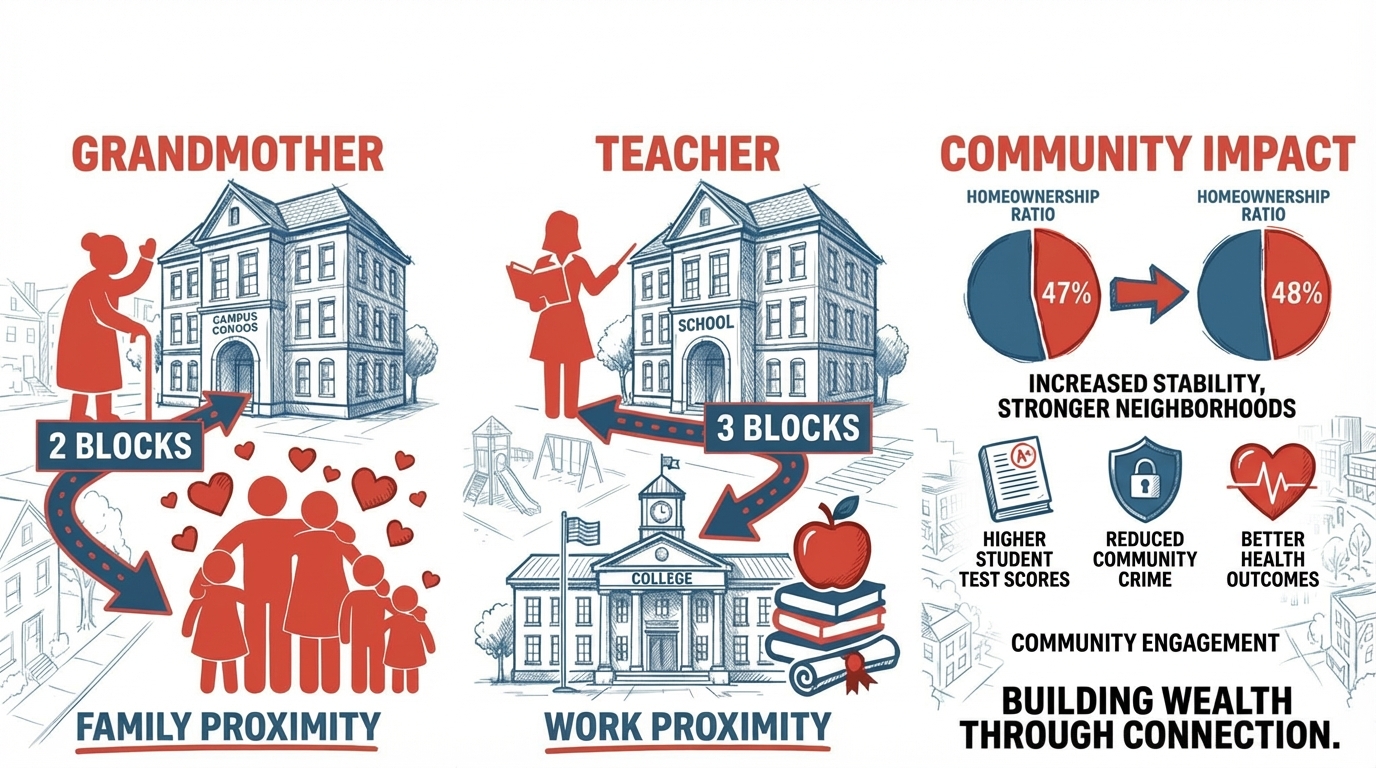

case study: Campus Condos | Portland, Oregon

The community impact

14 Apartment Units converted into StarterHomes

Neighborhood stabilized

Rent - to - Mortgage Parity proven.

Average Rent: $1,250 | Current Mortgage: $1,250

the wealth impact

Homes at 80% Area Median Income (AMI)

20% down payment assistance

Mortgage parity with current rent payment

Permanent wealth-building opportunity

Our Portfolio

Leadership Team

John Laine

Founder

Jerry Miller

CEO

FAQs Answered

1) What is StarterHome.Fund?

StarterHome.Fund is an evergreen real estate investment fund designed to bridge the gap between investor returns and community impact by expanding access to affordable homeownership.

2) How does the model work (in simple terms)?

We buy distressed multifamily properties at deep discounts (through nonprofit partnerships and distressed channels), complete condo-grade renovations, convert to condos, and then sell homes to qualified first-time buyers—supported by down payment help so monthly payments are achievable.

3) What are the investment terms?

The current offering is Common Equity with a target of 15–18% Average Annual Return (AAR) and a $50,000 minimum investment.

4) How do you make homes affordable for buyers?

Homes are sold to 80% AMI owner-occupants, and we provide 20% down payment assistance (via a second mortgage structure) to reduce the upfront barrier and expand the buyer pool.

5) How does StarterHome.Fund protect affordability while still targeting investor returns?

The model combines discounted acquisitions (40–60% off ARV) with 20% down payment assistance for buyers at 80% AMI, designed to expand access to homeownership while pursuing the fund’s 15–18% AAR target.

Latest News & Blogs

7.5 Million Affordable Apartments Just Vanished

America lost over 7.5 million rentals under $1,000/month in a decade. Here's where they went—and who's profiting. ...more

Affordable Housing

February 04, 2026•4 min read

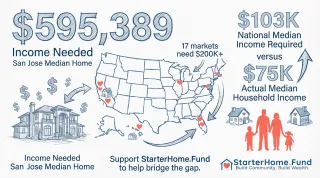

New Blog Post

San Jose needs a $595K salary to buy a median home. And it’s not alone. ...more

Affordable Housing

February 02, 2026•3 min read

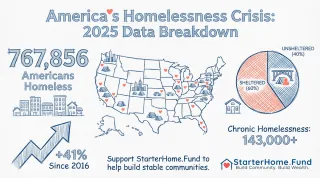

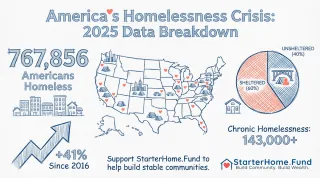

America's Homelessness Crisis

Nearly 768,000 Americans are homeless. That's a 41% surge since 2016. And the crisis is accelerating. ...more

Affordable Housing

February 02, 2026•4 min read

Closing the Affordability Gap: What It Takes to Turn Rent Into Equity

Closing the Affordability Gap: What It Takes to Turn Rent Into Equity ...more

Affordable Housing

January 14, 2026•4 min read

Compassionate Capitalism: How Profit Motive Can Solve the Affordable Housing Crisis

For decades, affordable housing has been primarily a government-endorsed (top-down orchestration) endeavor, supported by 15,000 non-profit housing providers. The results speak for themselves: the cris... ...more

Affordable Housing

December 30, 2025•7 min read

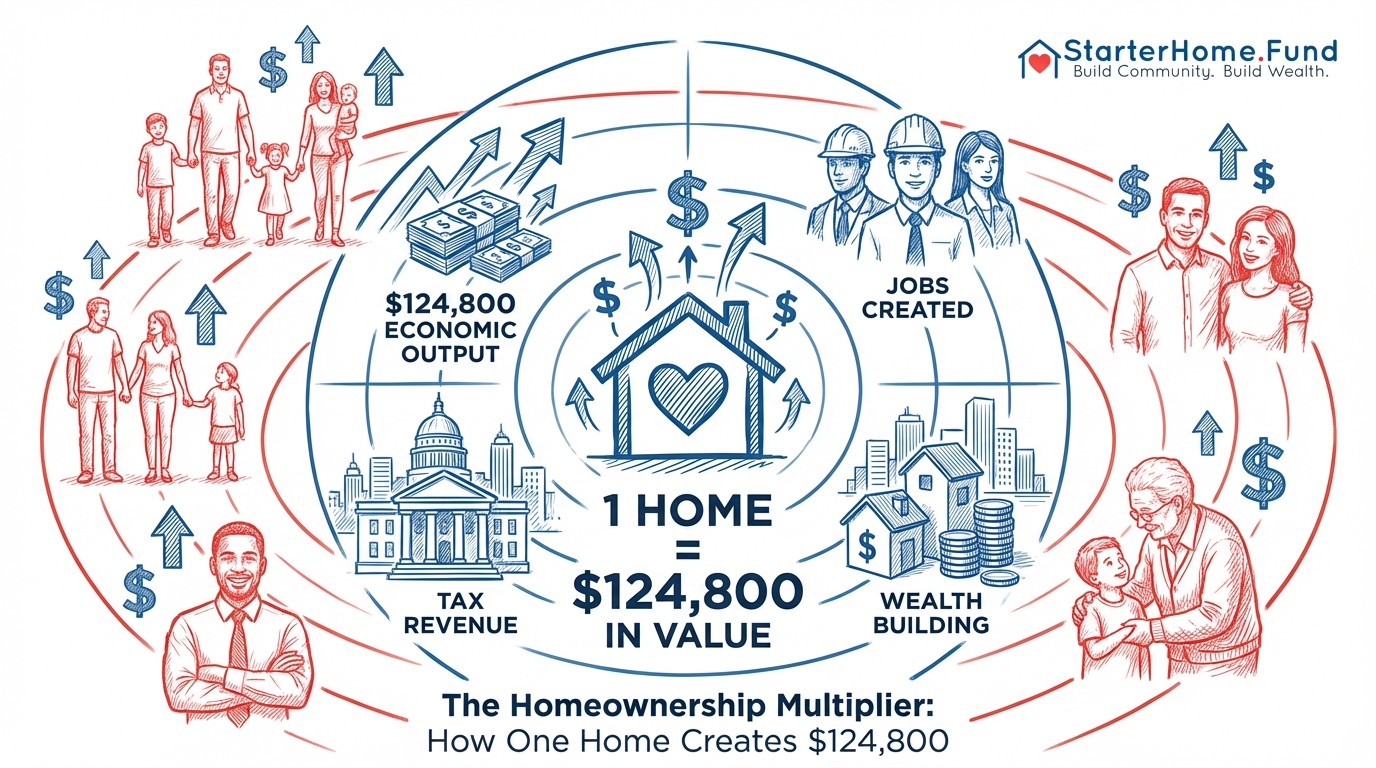

The Homeownership Multiplier: How One Home Creates $124,800 in Economic Value

The Homeownership Multiplier: How One Home Creates $124,800 in Economic Value ...more

Affordable Housing

April 24, 2025•4 min read